Introduction

The surge in crypto indices mirrors a change in investor attitudes towards digital assets.

As interest in cryptocurrencies continues to grow, the demand for diversified exposure and risk management becomes increasingly clear.

In this guide, we will delve into:

And much more, to provide valuable insights for digital asset investors.

Understanding the Crypto Index:

Today, there are a wide variety of crypto indices available, catering to different investment objectives and risk tolerances.

Following the inception of Bitcoin in 2009, the initial crypto indices emerged catering to high-net-worth investors. These early indices, although small and unregulated, marked the beginning of a new era in the cryptocurrency market.

Cryptocurrency indices differ in their investment strategies. Some indices invest in well-known cryptos like Bitcoin and Ethereum, while others prefer newer and riskier tokens.

Specific crypto indices cater to niche areas like DeFi and NFTs, targeting investors interested in specialized sectors.

Ref: Performance measurement of crypto funds (Niclas Dombrowski, Wolfgang Drobetz, Paul P. Momtaz)

Increasing institutional interest, innovative products, and overall market growth are driving the crypto index fund industry’s growth. As the crypto market evolves, the index industry is likely to continue expanding.

Crypto index funds aim to mirror the performance of specific cryptocurrency market benchmarks, offering investors exposure to various opportunities within the digital asset ecosystem.

This involves aligning investment strategies with criteria like market valuation of top cryptocurrencies or custom-designed indices by experienced managers.

Crypto indices differ from actively managed ones through their passive investment approach.

These adopt a passive tracking approach, minimizing human bias and emotions for a systematic and impartial investment strategy.

Types of Crypto Indices:

Cryptocurrency indices encompass various investment vehicles, each tailored to cater to varying investment objectives and risk profiles.

Delving into the realm of crypto indices reveals a spectrum of options, including:

- Market Cap Weighted Indices: Market cap-weighted indices allocate assets based on the market capitalization of individual cryptocurrencies, giving more weight to those with higher market capitalization. This method reflects their prominence and stability during market fluctuations, making them popular with investors.

- Equal Weighted Indices: Equal-weighted indices offer balanced exposure to various assets, including smaller companies. Unlike market cap-weighted indices that favor larger companies. Ideal for investors looking to diversify without bias towards larger eligible assets.

- Sector-Specific Indices: Sector-specific crypto indices focus on specific sectors like DeFi, NFTs, and privacy-focused coins. These allow investors to capitalize on emerging trends and niche opportunities to align with their strategic objectives.

- Actively Managed Indices: Actively managed crypto indices use dynamic techniques for higher returns and risk management. These aim to outperform benchmarks and attract investors with market expertise. Investors can choose from a variety of crypto indexes tailored to their needs, focusing on stability, diversification, thematic exposure, or active management.

How to Invest in Crypto Indices:

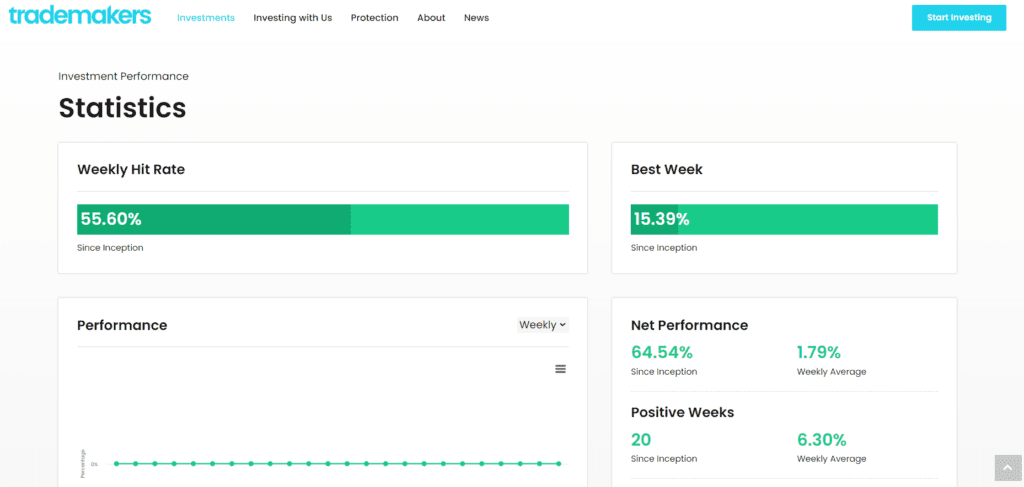

Investing in a Crypto Index is accessible to investors through online platforms (e.g ICONOMI, Trademakers, Xwin), cryptocurrency exchanges, and traditional brokerage accounts.

Ref : BCIF Index in TradeMakers

The following steps outline the process of investing in crypto indices:

- Research and Due Diligence: Begin by researching different crypto indices available in the market. Evaluate factors such as index methodology, investment strategies, management fees, historical performance, and regulatory compliance.

- Select a Suitable Index: Assess your investment goals, risk tolerance, and time horizon to identify a crypto index that aligns with your objectives. Consider factors such as diversification, index constituents, asset allocation, index size, and reputation of the index manager or issuer.

- Open an Investment Account: Once you’ve selected an index, open an investment account with the platform or brokerage offering the index. Ensure that the platform is reputable, secure, and compliant with regulatory requirements to safeguard your investments.

- Fund Your Account: Transfer funds into your investment account to facilitate the purchase of shares in the chosen crypto index. Some platforms may accept fiat currency deposits, while others may require cryptocurrency deposits for investment.

- Purchase Shares: Using the funds available in your investment account, initiate the purchase of shares in the selected crypto index. Specify the desired number of shares based on your investment strategy and portfolio allocation.

- Monitor and Review: After investing in a crypto index, focus on tracking the performance of your investment regularly. Monitor key metrics like NAV, asset allocation, expense ratio, and benchmark performance against market indices.

- Rebalance and Adjust: Regularly rebalance your portfolio to maintain desired asset allocation and adjust your investment strategy as needed based on changes in market conditions or your financial goals.

Occasionally review your investment portfolio and consider rebalancing your asset allocation if necessary. Rebalancing involves realigning your portfolio weights to maintain your desired risk-return profile and investment objectives.

Risks and Considerations:

While crypto indices offer compelling advantages, investors should be mindful of the following risks and considerations:

- Market Volatility: High volatility and price fluctuations define the cryptocurrency market, exerting notable influence on the performance of crypto indices.

- Law Uncertainty: Government policies and regulatory developments may affect crypto indices’ legality and working framework.

- Security Risks: Some crypto indices rely on third-party custodians, posing risks like theft, fraud, and functional weaknesses to investors.

- Liquidity Constraints: Certain cryptocurrencies may exhibit limited liquidity, resulting in wider bid-ask spreads and potential challenges in executing large trades within the index.

- Market Control: The cryptocurrency market is susceptible to market influence, pump-and-dump schemes, and fraudulent activities.

Assessing the crypto index performance requires an understanding of key metrics and systematic tools used to evaluate investment performance:

- Total Return: Calculates the overall return of the crypto index, including capital appreciation, dividends, and distributions over a specific period.

- Sharpe Ratio: Measures risk-adjusted return, indicating excess return per unit of risk for investors.

- Tracking Error: Measures how accurately the index replicates benchmark returns.

- Volatility: measures the price fluctuation and risk exposure of the index over time.

For more information about performance tracking, check out this article: Cryptocurrency index fund.

BCIF Crypto Index: Data-Driven, Zero-Emotion

The BCIF Crypto Index emphasizes data-driven strategies and top-tier cryptocurrencies, offering innovative opportunities in digital asset investing.

It provides investors with a distinctive pathway to see the growth potential in the crypto world.

Founded on the principles of Transparency, Accessibility, and Performance, BCIF sets itself apart by championing a zero-emotion, data-driven approach to cryptocurrency investing.

Investing in the BCIF Crypto Blue Chip Index

Investing in the BCIF Crypto Blue Chip Index presents lots of advantages for investors interested in the crypto market.

First, BCIF Performance of last months was impressive, for us and for any investor. Find more details about BCIF Composition and Performance in our last Weekly Update here.

Here’s how participation in this index can be advantageous:

- Diversification: Diversify your portfolio to spread your investment across a range of leading cryptocurrencies and avoid risks associated with focusing on a single cryptocurrency.

- Exposure to Major Players: Gain access to reliable and well-established major cryptocurrencies. This allows you to capitalize on their growth potential in the digital asset market.

- Simplicity and Convenience: Access the crypto market conveniently with the BCIF Crypto Blue Chip Index. Simplify your investment strategy and mitigate the complexities of individual cryptocurrency investments.

- Professional Management: Trust experienced professionals managing the BCIF Crypto Blue Chip Index for informed cryptocurrency selection and allocation, benefiting from their expertise and insights.

- Market Representation: Align your investment strategy with market trends of top cryptocurrencies.

- Potential for Growth: Benefit from the growth potential of established blue chip cryptocurrencies, capitalizing on the evolving cryptocurrency market.

- Liquidity: Benefit from enhanced liquidity in the BCIF Crypto Blue Chip Index for efficient buy or sell transactions. This increases flexibility in managing your investment portfolio.

That’s why, Now is a perfect opportunity to seize the potential benefits offered by the BCIF Crypto Blue Chip Index. Click here to explore exciting investment opportunities without lifting a finger with Best Crypto Index.

Conclusion

Cryptocurrency indices offer investors a fun and diverse way to dive into the ever-changing digital asset market. With many options available, investors can find the perfect match for their investment goals and risk appetite. And while starting is easy, it’s essential to research thoroughly. You should stay informed, and understand the potential risks involved. Despite the ups and downs and the uncertain laws, crypto indices open doors for growth and creativity. It makes them an exciting choice for investors looking to ride the wave of the booming blockchain industry.