The Best Crypto Index (BCIF) emerges as a pioneering force, reshaping the landscape of cryptocurrency investment.

BCIF is a cryptocurrency-focused company that concentrates on the most well-known cryptocurrencies based on their market capitalization. This approach sets BCIF apart in the rapidly evolving cryptocurrency industry.

The ascent of cryptocurrency as a pivotal player in financial markets marks a significant evolution in the investment world.

Cryptocurrency used to be considered a niche and speculative investment, but now it’s a popular option for both individual and institutional investors.

In emerging economies, digital currencies are gaining recognition as powerful tools for economic growth.

In response to this transformative trend, BCIF has positioned itself as a vanguard, championing meticulously researched, data-driven investment approaches within the crypto domain.

The index’s strategic emphasis on blue chip cryptocurrencies offers a unique blend of stability and growth potential.

BCIF is a cryptocurrency investment leader that combines stability with innovation. They offer a balanced investment approach for those interested in making gains from digital currency. They are prudent, yet progressive, and are well-equipped to navigate the cryptocurrency investment arena.

The Swiss ISIN Advantage

Source : ISIN

Incorporating a Swiss ISIN into investment strategies brings a multitude of advantages, particularly for global investors.

Switzerland, known for its political stability, robust economy, and exceptional financial acumen, stands as an ideal environment for investments.

The integration of Swiss ISINs is indicative of stringent security standards and meticulous precision, traits that are emblematic of the Swiss financial landscape.

This stellar reputation provides investors with an additional layer of confidence and dependability, which is invaluable in today’s investment world.

BCIF crypto blue chips has made it easier and safer for its clients to invest in cryptocurrency by integrating the Swiss ISIN into its Workflow system.This strategic move offers clients a secure and standardized method for investing in cryptocurrency.

By adopting the Swiss ISIN, the BCIF has made cryptocurrency investments more accessible and secure for its clients.

This approach significantly demystifies the investment process for global investors, presenting them with a reliable and familiar structure in the often turbulent and intricate domain of cryptocurrency investment.

The Swiss ISIN aligns with BCIF’s values of offering safe opportunities for investment in an index fund. This shows that the index is committed to providing trustworthy and excellent services in the digital finance world.

Data-Driven Diversification Strategy

With a data-driven development strategy, The BCIF Blue Chip Index stands to make informed and strategic investments.

Based on comprehensive studies of the crypto industry and performance metrics, this approach targets up to 30 of the largest cryptocurrencies by market capitalization.

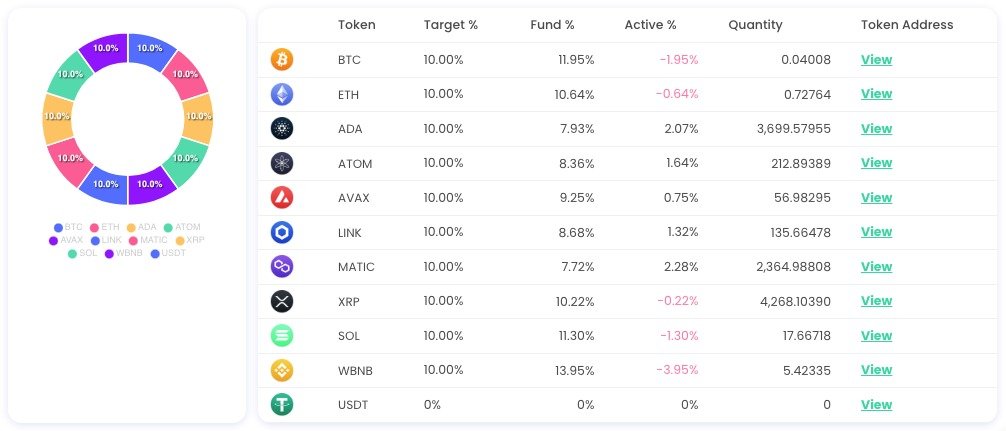

Decentralized Investment Chart : xBCIF Crypto Index

This methodical process involves analyzing market data in-depth, aimed at identifying multiple cryptocurrencies that are not only significant by market presence but also show promising signs of stability and growth.

By Combining a wide array of top-performing digital currencies, BCIF crafts a diversified investment portfolio that minimizes reliance on any single cryptocurrency. This diversification is a crucial aspect of BCIF’s strategy, as it effectively spreads risk across a variety of assets, mitigating the inherent volatility and unpredictability of the crypto market.

The advantages of BCIF’s diversification strategy are multifaceted.

Diversification is an essential risk management tool, particularly in the fluctuating world of cryptocurrencies. By allocating investments across a diverse range of crypto assets, BCIF’s strategy provides a safeguard against market volatility and the specific risks associated with individual cryptocurrencies.

Additionally, this approach harnesses the collective growth potential of the broader crypto market, enabling investors to capitalize on the general upward trends of these leading digital currencies.

Ultimately, BCIF’s data-driven diversification strategy strikes a harmonious balance between risk management and growth potential.

It presents an attractive option for investors who seek a thorough and balanced approach in the ever-changing landscape of traded cryptocurrency investment.

We help investors in the crypto market by providing them with data and market insights. This enables them to make informed decisions about their investments and feel confident about their strategies. The approach of BCIF is both careful and innovative.

Tackling Cryptocurrency Volatility

Cryptocurrency prices are known for changing rapidly because of different reasons like changes in regulations, advances in technology, market sentiment, and speculative trading. This makes the cryptocurrency market unpredictable and volatile.

BCIF (Best Crypto Index) confronts this volatility head-on with a data-driven portfolio construction strategy. By focusing on the top 18 cryptocurrencies by market capitalization, BCIF carefully selects assets that have demonstrated not only resilience but also a degree of stability in the ever-turbulent crypto landscape.

This approach serves as a stabilizing force against investment risks by prioritizing a more established and widely recognized group of cryptocurrencies, which generally exhibit lower volatility compared to their lesser-known counterparts.

In the art of portfolio balancing, BCIF leverages quantitative data encompassing market capitalization, liquidity, historical performance, and price trends. This data-driven methodology facilitates a rational and systematic allocation of assets, a pivotal element in managing the innate risks associated with the crypto market.

Through continuous monitoring of market data, BCIF retains the agility to dynamically adjust its portfolio, ensuring a balanced investment strategy that offers a more reliable path for its clients amid the unpredictable waves of crypto market volatility.

Easy and Efficient Market Access

The Swiss International Securities Identification Number (ISIN) is a pivotal tool in revolutionizing the accessibility of cryptocurrency investments. This 12-digit alphanumeric code uniquely identifies digital assets, including cryptocurrencies, and plays a transformative role in simplifying the investment process.

In contrast to conventional cryptocurrency investment methods, which often involve navigating complex and fragmented exchange platforms, the Swiss ISIN presents a streamlined and user-friendly alternative.

Traditional crypto investments necessitate dealing with disparate procedures and security protocols across multiple exchanges, creating barriers for newcomers to the crypto sphere.

Cryptocurrency investments have become more familiar and orderly since the introduction of the Swiss ISIN.

This new system mirrors the structure of traditional financial markets, making it easier for investors to navigate. This standardized system significantly lowers the entry threshold for investors, making cryptocurrency investments more approachable and less intimidating.

By integrating Swiss ISINs, investors can seamlessly incorporate popular cryptocurrencies into their portfolios, akin to adding traditional assets like stocks or bonds.

This not only simplifies the investment journey but also broadens the cryptocurrency market’s appeal to a more diverse range of investors.

In essence, the Swiss ISIN democratizes crypto investments, removing complexity and enhancing accessibility, ultimately expanding the potential investor base and driving broader adoption in the dynamic world of cryptocurrencies.

Adapting to Market Changes

The cryptocurrency market is renowned for its inherent dynamism, characterized by rapid shifts influenced by regulatory changes, technological advancements, and market sentiment.

In this context, BCIF (Best Crypto Index) demonstrates a keen understanding of the necessity for adaptability.

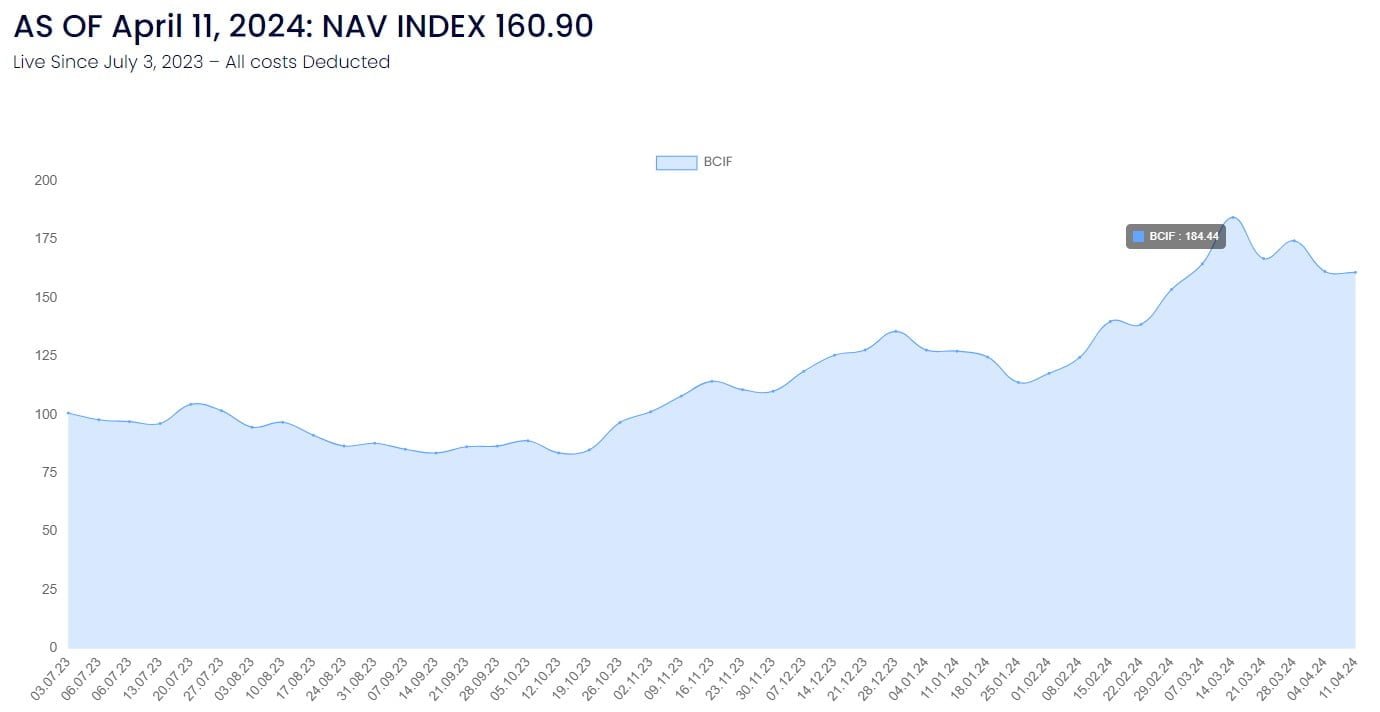

BCIF’s investment strategy is marked by its agility, primarily achieved through weekly adjustments.

This approach enables BCIF to promptly respond to market fluctuations, ensuring that its investment portfolio remains finely tuned to the prevailing market dynamics.

This responsiveness acts as a crucial risk mitigation tool in the ever-changing crypto landscape.

Moreover, this crypto index strategy stays at the forefront of innovation by actively incorporating emerging cryptocurrencies into its investment strategy. This entails continuous market monitoring for promising digital assets that meet stringent criteria, including market capitalization, liquidity, and technological innovation.

By doing so, it not only capitalizes on the growth potential of emerging assets but also diversifies its portfolio, thereby reducing risk exposure.

In essence, BCIF’s commitment to adaptability positions it as a dynamic player in the cryptocurrency investment realm, capable of navigating the intricacies of the market, harnessing opportunities, and optimizing returns for its investors.

Cost-Effective Investment Solutions

Investing in BCIF (Best Crypto Index) offers substantial economic advantages, particularly regarding cost-efficiency. Its structure is meticulously designed to alleviate the financial burden on investors, rendering it an enticing choice for those seeking efficient crypto market investments.

One of the pivotal cost-saving measures implemented by BCIF is the mitigation of multiple transaction fees. Traditional individual cryptocurrency investments often entail numerous transactions, each incurring separate fees that can swiftly accumulate, especially for frequent portfolio adjustments. BCIF’s approach is to provide investors with a diversified cryptocurrency portfolio through a single investment channel, drastically curbing these transaction costs.

Furthermore, BCIF simplifies investment management. Managing an individual cryptocurrency portfolio necessitates continuous vigilance and adjustments, consuming both time and capital. This crypto blue chip index strategy focuses on top cryptocurrencies by market capitalization, expertly managed by seasoned professionals.

This strategic framework liberates individual investors from the intricacies of micromanaging their investments. Consequently, this streamlined approach not only trims direct costs but also conserves investors’ precious time and resources, making it a highly cost-effective solution for crypto investments.

Commitment to Security and Precision

BCIF (Best Crypto Index ) places a paramount focus on the security measures and precision synonymous with Swiss financial services. Switzerland’s financial sector is globally renowned for its resilience, underpinned by stringent security protocols and an unwavering reputation for precision and dependability.

BCIF’s alignment with these esteemed Swiss standards underscores its commitment to providing secure investment solutions. We collaborate with Swiss financial institutions and follow strict cybersecurity and financial regulations to fulfill our commitment. By integrating these exacting standards of security and precision into its operations, BCIF not only fosters innovation but also guarantees the security and reliability of its investment solutions.

The index security approach is multifaceted, encompassing both technological safeguards and regulatory compliance. Our top priority is protecting our investors, which is why we implement advanced security measures for digital asset trading. We also comply with Swiss financial regulations to ensure investor protection.

I confirm from my experience in the field that, ‘blue chip crypto index’ unwavering dedication to security and precision within its investment solutions underscores its commitment to providing clients with a dependable platform for cryptocurrency investment.

Embrace the Future of Crypto Investment with BCIF

We extend a warm invitation to prospective investors to embark on a transformative journey with BCIF (Best Crypto Index).

At BCIF, we specialize in cryptocurrency investment and pride ourselves on carefully selecting blue-chip crypto assets while maintaining the highest level of precision and security, following Swiss financial practices.

We have a chance to embrace a new era where decision-making is guided by a data-driven approach to crypto.

By joining BCIF, you become an integral part of a community that places immense value on rational, well-informed investment strategies within the dynamic realm of blockchain investments.

Unveil the full potential of cryptocurrencies, underpinned by BCIF’s expertise and robust methodology.

Take the decisive step towards a future where your investments are not only safeguarded but strategically poised for growth in the digital asset domain.

This is the time to secure your place in the future of crypto investment. Join BCIF and seize the opportunities that lie ahead.