Cryptocurrency investment has emerged as a lucrative avenue for investors seeking high returns in the digital age. The promise of significant gains entices many to the dynamic world of digital assets.

However, the volatile nature of the crypto market underscores the importance of adopting a diversified investment approach.

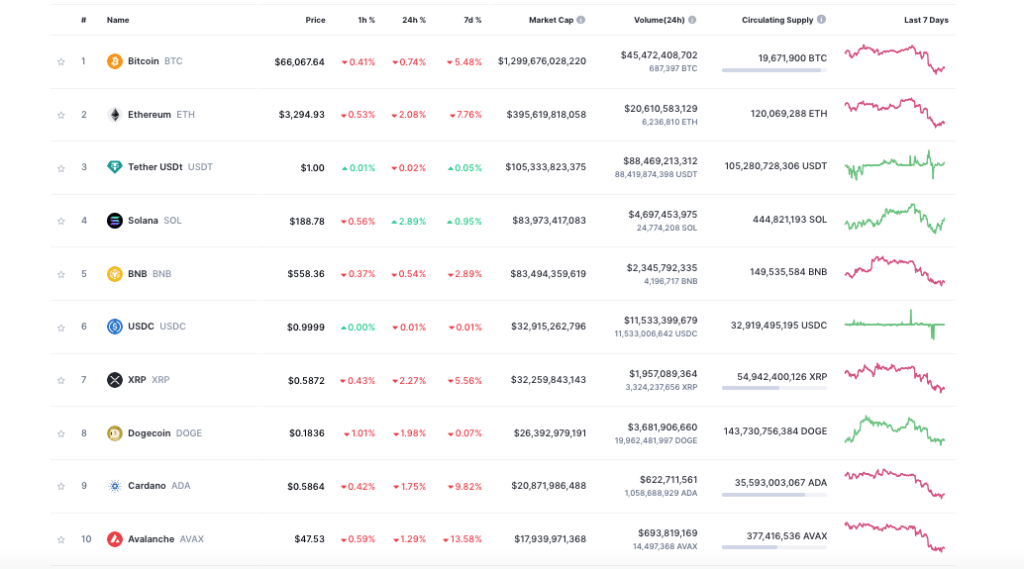

The cryptocurrency market comprises a diverse array of digital assets, ranging from established giants like Bitcoin and Ethereum to a myriad of alternative coins (altcoins) and emerging blockchain projects.

In an ecosystem marked by rapid fluctuations and unpredictable trends, diversification serves as insurance against potential losses while amplifying opportunities for long-term growth.

As such, understanding the principles of portfolio diversification becomes paramount in navigating the complexities of cryptocurrency investment, offering a strategic pathway towards financial product resilience and sustainability.

The cryptocurrency market is influenced by various factors, including supply and demand, market sentiment, regulatory developments, and technological advancements.

In this comprehensive guide, we delve into the strategies and considerations for diversifying your crypto portfolio to mitigate risk and optimize returns.

What is a Crypto Portfolio?

Understanding a Crypto Portfolio

A crypto portfolio is a selection of cryptocurrencies chosen by an investor to maximize returns within their overall investment portfolio.

A well-balanced crypto portfolio contains multiple types of cryptocurrencies with different risk levels and use cases.

Components of a Diversified Crypto Portfolio

To succeed in the cryptocurrency market, it’s not enough to rely on speculation alone. You need to have a solid strategy and make wise decisions to navigate through the unpredictable market.

To achieve that, it’s crucial to plan strategically and make prudent choices based on informed assessments.

Investors looking to secure their positions in the dynamic market of digital assets should focus on diversification. The concept of diversification is essential for any resilient investment strategy.

It involves understanding the key components of a diversified crypto portfolio. By doing so, investors can harness the full potential of this market.

Components of a Crypto Portfolio:

- Major Cryptocurrencies: The anchor of your portfolio, these established players like Bitcoin and Ethereum boast wider adoption, stability, and a proven track record. Think of them as the solid gold bars that form the foundation of your financial fort.

- Alternative Coins (Altcoins): Beyond the prominent names lie the vast and diverse world of altcoins. These offer the potential for higher returns but also come with increased risk. Consider them the exotic gems that add sparkle and potential for explosive growth to your portfolio.

- Stablecoins: Stablecoins unlike traditional currencies are a haven in the volatile crypto market. They connect these coins to real-world assets (Fiat currency) like the US dollar, offering stability and liquidity. They help you weather market fluctuations without risking your investments.

- Other Digital Assets: The crypto ecosystem is constantly evolving, offering new and exciting investment opportunities. This could include non-fungible tokens (NFTs), decentralized finance (DeFi) products, or even blockchain-based real estate tokens. Think of them as the rare artifacts and hidden gems that add unique value and diversification to your collection.

Remember, the asset allocation within your crypto portfolio is unique to you. It depends on your risk tolerance, investment goals, and the ever-changing market landscape.

A seasoned investor might have a higher allocation to altcoins for aggressive growth, while a beginner might prioritize stability with a larger share of stablecoins.

Benefits of Diversification in Crypto

Diversification is a crucial strategy in the ever-changing world of cryptocurrency investment. By investing in a range of crypto assets, diversification provides numerous advantages in navigating the intricacies of the market. It helps spread out investments and offers a multitude of benefits.

- Hedging Against Volatility

One of the primary benefits of diversification is its ability to hedge against volatility. Cryptocurrency markets are extremely volatile, with prices often experiencing rapid fluctuations driven by factors such as market sentiment, regulatory developments, and technological advancements.

By spreading investments across different assets, investors can mitigate the impact of cryptocurrency price swings on their overall portfolio.

- Reducing Overall Risk Exposure

Diversification also helps to reduce overall risk exposure by minimizing the impact of adverse events affecting specific cryptocurrencies or market segments.

Although individual assets may experience price declines or fluctuations, a diversified cryptocurrency portfolio is better positioned to withstand such challenges and preserve capital over the long term.

- Capturing Different Market Trends

Furthermore, diversification enables investors to capitalize on different market trends and investment opportunities within the crypto ecosystem.

By allocating funds to a diverse range of assets, investors can participate in various sectors such as decentralized finance (DeFi), non-fungible tokens (NFTs), and emerging blockchain platforms, thereby enhancing the growth potential of their crypto portfolio.

And with diversification, investors position themselves to thrive amidst the ever-evolving dynamics of the crypto ecosystem, fostering resilience and unlocking untapped growth opportunities.

Factors to Consider Before Diversifying

Before diving headfirst into the exciting world of diversified crypto holdings, it’s crucial to take a step back and assess your circumstances and the broader market landscape.

Here are some key factors to mull over before crafting your personalized crypto portfolio:

Understanding Yourself:

- Chart Your Course: Clearly define your investment goals. Are you seeking short-term profits to fuel your wanderlust, or are you aiming for long-term wealth accumulation for your golden years? This objective will shape your risk tolerance and guide your coin selection.

- Know Your Limits: Be honest with yourself about your risk tolerance. The crypto market is a rollercoaster, so be sure you’re comfortable with the potential for gut-wrenching dips alongside exhilarating climbs. Please remember to invest only what you can afford to lose.

Decrypting the Cryptoverse:

- Market Capitalization: Consider the size and stability of the coin. Large-cap coins like Bitcoin are generally safer, while small-cap coins offer higher growth potential (and risk).

- Project Fundamentals: What problem does the coin solve? Is there a strong team and community behind it? Does the technology have a strong foundation? Avoid investing in projects that you don’t fully understand.

- Practical value: What problems does the coin solve? Does it have real-world applications or is it purely speculative?

- Industry Diversification: Don’t put all your eggs in one basket. Spread your investments across different sectors like DeFi, NFTs, or gaming to mitigate risk.

- Geography: Consider the geographic reach and focus of the project. This can be relevant depending on your investment goals and risk tolerance.

- Blockchain Protocol: Different coins use different consensus mechanisms (e.g., Proof-of-Work, Proof-of-Stake). Understand the implications of each on security, scalability, and energy consumption.

- Token Type: Explore different token types like stablecoins, utility tokens, and governance tokens. Each has unique characteristics and purposes.

Additional Tips:

- Do Your Research: Don’t blindly follow online financial gurus. Read whitepapers, join communities, and immerse yourself in the project before committing your hard-earned cash.

- Start Small, Scale Smart: Diversify gradually and build your portfolio over time. Exercise caution before investing all your resources into a single coin.

- Rebalancing is Key: As the market evolves, your crypto portfolio might need adjustments to maintain your desired risk profile. Rebalancing regularly ensures your diversification strategy stays on track.

- The Land of High Volatility: When you invest in the crypto market, make sure you’re ready for potentially extreme price fluctuations. You should plan for both the highs and lows and only invest money you can afford to lose.

Types of Cryptocurrencies for Diversification

Source (Portfolio CoinMarketCap)

Now that you’ve grasped the essential factors for crafting a diversified crypto portfolio, let’s delve into the exciting world of different coin types!

Remember, diversification isn’t just about spreading your holdings across various projects; it’s also about integrating different functionalities and purposes within your portfolio. Here’s a breakdown of some key categories to consider:

Payment Coins:

- Bitcoin (BTC): The OG cryptocurrency, Bitcoin remains a dominant force with its established network and global recognition. While its price movements can be significant, its stability makes it a solid foundation for many diversified portfolios.

- The Ethereum Ecosystem: The leading platform for smart contracts and decentralized applications (dApps), Ethereum offers a vibrant ecosystem with various payment-focused tokens like Dai (DAI) and USD Coin (USDC). Consider these for their potential growth and utility within the Ethereum dApp landscape.

Utility Tokens:

- Fueling the DeFi Engine: Chainlink (LINK): This token powers decentralized oracles, providing secure and reliable data feeds for DeFi applications. Its role in the burgeoning DeFi space makes it an attractive option for those seeking exposure to this rapidly evolving sector.

- Gaming Guilds Rise: Axie Infinity Shards (AXS): This token fuels the popular play-to-earn game Axie Infinity. As the gaming-on-blockchain trend explodes, tokens like AXS offer exposure to this exciting new frontier.

Governance Tokens:

- Shaping the Future: Maker (MKR): This token grants holders voting rights within the MakerDAO governance system, allowing them to influence the stability and direction of the DAI stablecoin. Consider governance tokens for projects you believe in and want to actively participate in their development.

Stablecoins:

- Hedging Against Volatility: Tether (USDT) and USD Coin (USDC): These tokens are pegged to the US dollar, offering a haven during market downturns. They also facilitate efficient trading between different cryptocurrencies.

Non-Fungible Tokens (NFTs):

- Owning the Uniquely Digital: While not strictly currencies, NFTs represent unique digital assets like artwork or collectibles. Diversifying into a curated selection of NFTs can add another layer of diversification and potential for appreciation.

Remember, this is just a glimpse into the diverse crypto landscape. Each category encompasses numerous projects, each with its unique value proposition.

Strategies for Diversifying Your Crypto Portfolio

Diversification is a fundamental principle to safeguard your investments and foster long-term prosperity in the crypto world.

By strategically allocating your capital across various asset classes and sectors, you can mitigate risk, enhance stability, and position yourself to capitalize on great opportunities.

Embrace the Power of Multifaceted Portfolios:

- Beyond Binary Choices: Resist the temptation to concentrate your holdings on a single project or token. Instead, embrace a multi-pronged approach that distributes your investments across established market leaders like Bitcoin (BTC) and Ethereum (ETH), promising mid-cap contenders, and even high-growth, high-risk ventures. This strategic distribution mitigates the impact of individual project failures and fosters a more resilient crypto portfolio.

- Sector Savvy: Delve deeper than mere token types. Explore promising sectors like decentralized finance (DeFi), non-fungible tokens (NFTs), play-to-earn gaming, and the burgeoning metaverse. By understanding the unique dynamics and risk-reward profiles of each sector, you can construct a crypto portfolio that aligns with your risk tolerance and investment goals.

- Globally Aware: Don’t confine yourself to geographically concentrated projects. Seek out ventures with diverse teams and communities spanning the globe. This global diversification exposes you to a wider range of market influences and perspectives, potentially enhancing your risk management strategy.

DCA: Your Ally in Market Volatility:

Source: Binance-DCA (Dollar Cost Averaging)

- Employ Dollar-cost averaging (DCA) as your secret weapon against market volatility. This disciplined approach involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. By averaging your cost per unit over time, you mitigate the emotional temptation to buy high and sell low, fostering long-term investment discipline.

Maintaining Portfolio Equilibrium:

- Nurturing Balance: As the market ebbs and flows, your portfolio’s composition might shift because of price fluctuations. Regularly engage in rebalancing, a strategic process of buying or selling assets to restore your desired allocation percentages across different categories. This ensures your portfolio remains aligned with your risk tolerance and investment objectives, even amidst market turbulence.

Knowledge is Power: Cultivating Informed Decisions:

- Never Stop Learning: The cryptocurrency landscape is a constantly evolving ecosystem. Cultivate a lifelong learning mindset by actively engaging with the community, reading whitepapers, and following industry news. By staying informed about project developments, potential risks, and emerging trends, you empower yourself to make sound investment decisions.

Embrace the Journey:

Diversification is a Marathon, Not a Sprint: Remember, diversification is not a one-time fix; it’s an ongoing journey that requires continuous assessment and adaptation. As your investment goals and the market evolve, refine your strategy accordingly, ensuring your crypto portfolio remains a thriving oasis amidst the ever-changing desert of the crypto landscape.

Incorporating Different Investment Vehicles

This section dives into the diverse world of crypto investment vehicles, empowering you to make informed decisions. Whether you’re a seasoned investor or just starting your crypto journey, understanding these options is crucial for navigating this dynamic market and managing a diversified crypto portfolio.

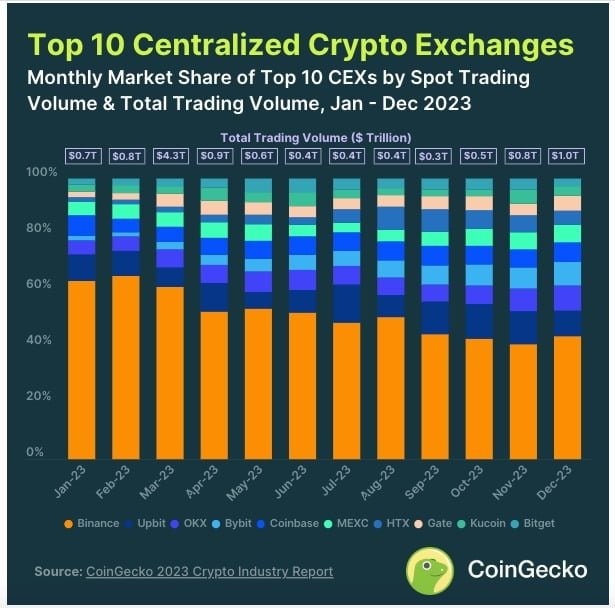

Crypto Exchanges & Trading Platforms:

These platforms are your gateways to buying and selling, and trading digital assets. From established giants like Binance to innovative OKX, the choices are plentiful.

But always keep in mind, that security comes first.

Choose reputable exchanges with robust security measures and regulatory compliance to minimize counterparty risk and protect your hard-earned crypto.

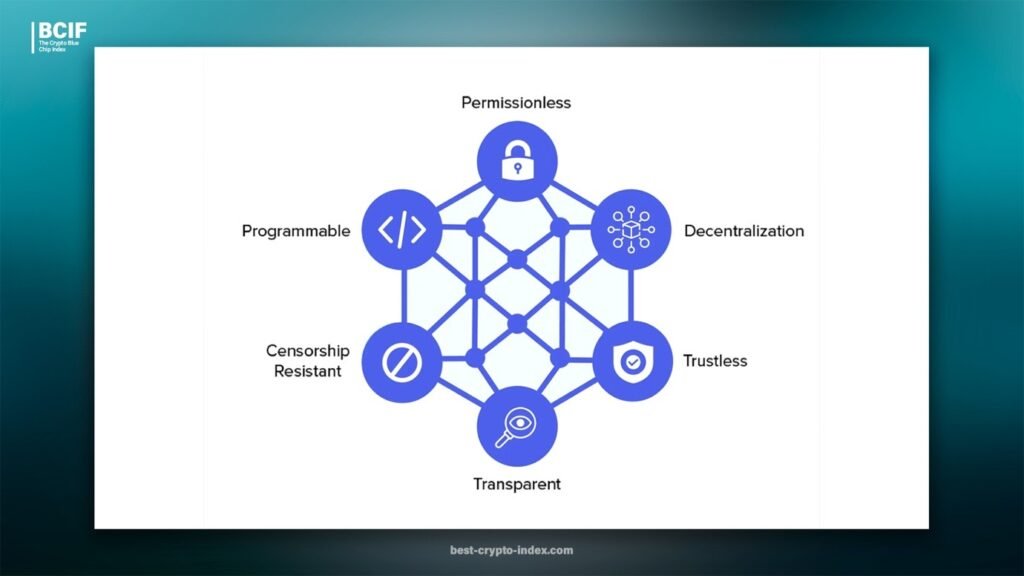

Decentralized Finance (DeFi) Protocols:

Imagine a financial system without mediators, powered by the transparency and stability of blockchain technology.

Borrow, lend, earn interest, and even trade – all without relying on traditional financial institutions.

While DeFi opens doors to financial inclusion and innovation, be mindful of potential risks like smart contract vulnerabilities, impermanent loss, and regulatory rules.

Additionally, peer-to-peer platforms offer an alternative way to buy, sell, and trade cryptocurrencies directly with other individuals, providing greater privacy and autonomy in trading.

Crypto Index & ETFs:

Want exposure to the cryptocurrency market without the hassle of managing individual assets?

Crypto index funds and ETFs offer a solution. These investment vehicles track the performance of specific crypto indices or baskets, providing diversified exposure and mitigating single-asset risk.

However, conduct thorough due diligence before investing. Consider factors like transaction fees, liquidity, and tracking errors to ensure they align with your investment goals.

Bonus: Crypto Portfolio Trackers:

For investors seeking comprehensive insights into their digital asset holdings, crypto portfolio trackers are invaluable tools.

These platforms allow users to monitor their portfolio’s performance in real-time, track changes in asset values, and analyze investment allocations.

By utilizing crypto portfolio trackers, investors can make informed decisions and adjust their strategies to optimize their investment outcomes.

Remember:

“The crypto space is constantly evolving, with new trends and regulations emerging frequently. Stay informed about Security Token Offerings (STOs), Non-Fungible Tokens (NFTs), and the evolving regulatory landscape to make informed investment decisions.”

Conclusion

Diversification is essential in cryptocurrency investment, offering resilience amidst volatility and capturing diverse market trends.

Understanding portfolio components, considering personal factors, and embracing strategies like multifaceted portfolios and disciplined decision-making are crucial.

While exploring various investment vehicles, vigilance against common pitfalls is necessary. By staying adaptable and committed to learning, investors can navigate the dynamic crypto landscape with confidence, aiming for long-term prosperity.